Arbitraging The Implied Correlation Index

Making money with a dispersion arbitrage strategy on a kept-secret index.

To understand how this strategy works, let’s first go over what the Implied Correlation index tells us.

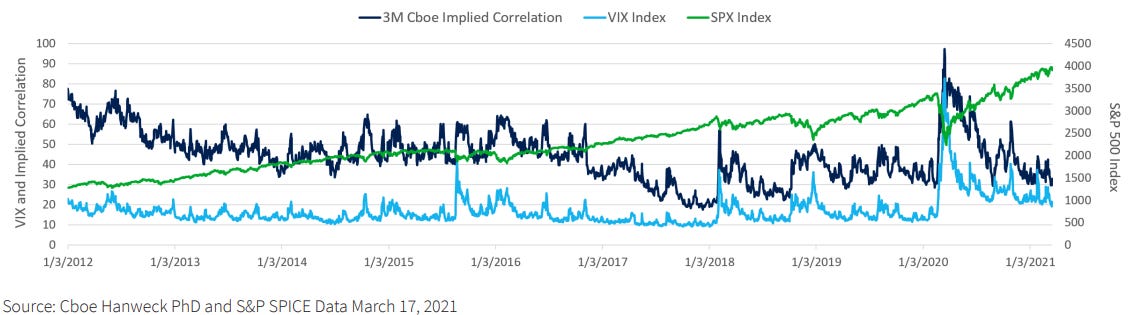

Put simply, the Implied Correlation index measures the market’s expectations for the correlation of the volatility of the top 50 stocks in the S&P 500. This was designed to act as a proxy that represented what’s known as diversification benefit. According to Modern Portfolio Theory, your overall risk is lower when you own a portfolio of stocks with a low correlation.

After the 2008 crisis, it became clear that just using historical volatility as a way to measure risk without looking at correlation was an incredibly dangerous game. Suddenly when widespread volatility picked up, products that had a low correlation (price-wise) suddenly had a high volatility correlation. So it goes from having a relatively stable basket of uncorrelated securities, to having an extremely volatile basket of uncorrelated securities.

Because the index is mainly exposed to volatility, it is somewhat correlated to the VIX and possesses many of the same mean-reverting tendencies you would expect. Here is a graph of how the two line up: