Google Search? Let's Arbitrage That.

Take a look at how we are able to post extraordinary returns by leveraging Google Search Volume.

We know that information is the #1 driver of returns in markets, but what if we came up with a way to measure the supply and demand of that information and then used it to generate abnormal returns?

Well, that’s exactly what we did.

Background

In order to make trades based on the supply and demand of information, we first need to build a way of measuring the data and finding the right stocks.

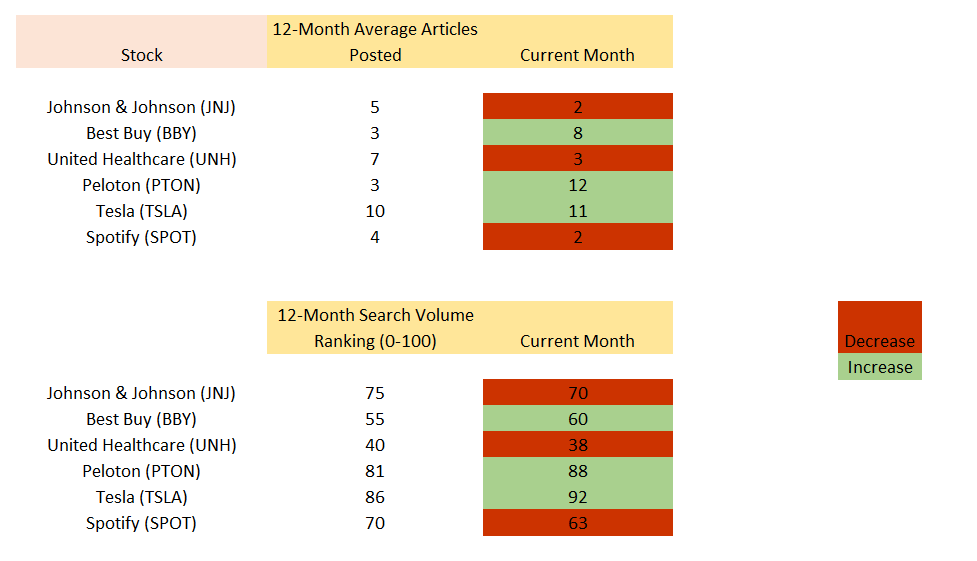

Our starting universe will be all stocks within the S&P 500. For each stock, we will collect the 12-month average of articles posted by pulling directly from Factiva, then we will collect the 12-month average search volume/ranking directly from Google Trends.

Once we have the historical average for all companies, we will then see how the current month compares to that average. Here’s what that looks like:

Before we assemble this into a trade, there’s just one assumption to glue everything together.