So, The Sports Betting Algorithm Did Something.

By factoring in machine learning techniques, we were able to expand into an entirely new market and found something potentially revolutionary.

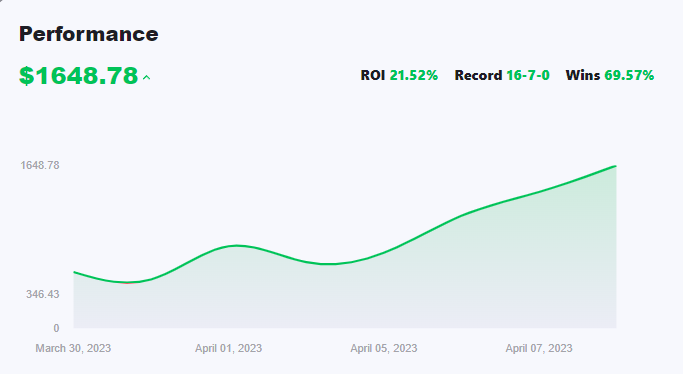

Our sports betting algorithm is off to a great start. From the start of the MLB season up to today, the performance stands at a 70% win rate for a 20% ROI.

This demonstrates the viability of the methodology used in our algorithm. But it also validates our prior idea that in the long-run, it will offer market-like returns, so ~ an annualized extra 7-10%. This is great considering it’s uncorrelated returns just from using math, but it isn’t exciting.

While the approach is viable long-term, the returns are just too slow. Returning 20% is great, but the goal isn’t to gain modest capital appreciation; it’s to make multiples.

So to do this, we called in some friends in the machine learning department.

If you’re new, I highly recommend starting here:

Regression is More Powerful Than You Think

So, we have a way of just determining which game will most likely be decided by statistical factors. We can consistently hit those estimates, but we only make significant profits in the long-run (>100 games). This means that we need to pair this bet up with another bet that we can hit at a similar probability. Combining these two bets together will allow us to meet the desired and optimal profit growth rate.

Prop Bets

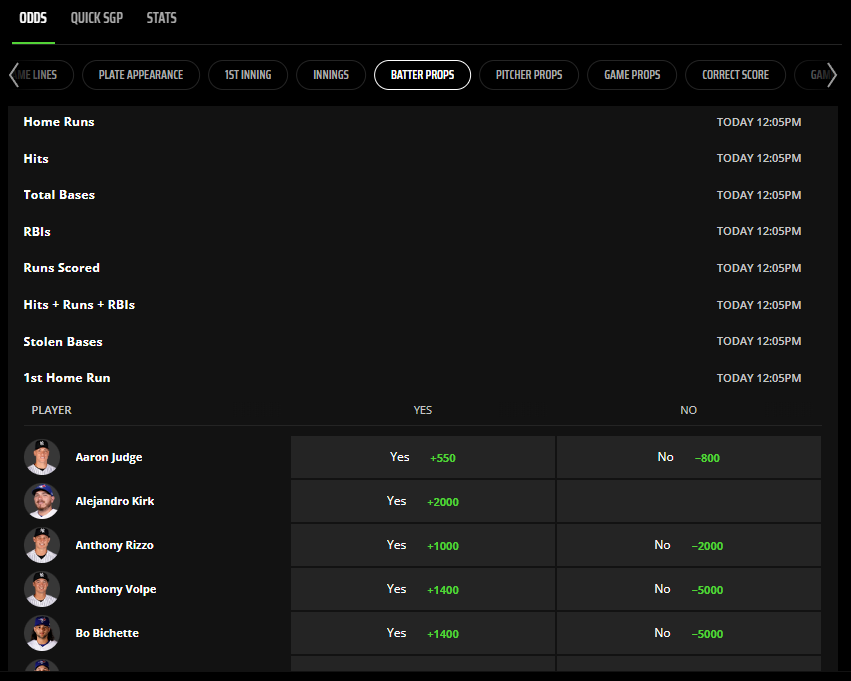

Prop bets are the financial derivatives of the sports betting world. Instead of speculating on the price at a point of expiration, you can wager on things like the score at time t, or how many x a player gets for the entirety of the game.

There is even less academic research and supporting material on trading these derivatives, so we were on our own. To start, I wanted to narrow down the bets that could be consistently predicted through statistical features and not chance. For example, while a player’s home run data can signify skill, it is a relatively infrequent event that is prone to high-variance and chance, so we skip it.

Keep reading with a 7-day free trial

Subscribe to The Quant's Playbook to keep reading this post and get 7 days of free access to the full post archives.