The ETF Game is ARK'd Up. [Code Included]

We're officially in a new market regime — it's time to change things up.

“Lots of delta 1 houses in the Hamptons. Not so many vol houses.” -- Agustin Lebron

“Reminder: whatever decile options trader you are, if you were that decile in delta 1, you'd be much richer.” — Kris Abdelmessih

Context: Delta 1 strategies refer to strategies that just long/short the underlying stock. Technically, it refers to all products with a delta of 1, but for simplicity, it just means buying or selling a stock — no options or complex derivatives.

As harsh as those perspectives seem, they definitely are interesting. When you imagine the typical fund manager’s summer home, more often than not, it actually is due to strategies that involve shares as opposed to options.

Further, we are in a “new” market regime — vol down, equity up. This is essentially the historical default state of markets hence the quotes around new, but nevertheless, we’re in and are likely to continue being in a regime where volatility remains muted and equity returns remain high.

So, this week, we’re going to take a break away from finding alpha in the volatility option space, and instead look for more of the structural kinds of alphas that tend to perform well in these regimes (extra emphasis on “break”, we’re right around the corner on a vol breakthrough).

And what better example of a structural alpha than a party that constantly trades in enormous size and then immediately tells the world what it did?

ARK Funds — Remember Them?

2020 — the year markets were defined by COVID, altcoins, and meme stocks. It was a different time, a more complex time, but not a forgotten time.

That year, the S&P 500 notched a pretty stellar 16% return, however, this spotlight was stolen by Cathie Wood’s ARK funds, with the flagship ARK Innovation ETF (ARKK) posting a jaw-dropping 148% return:

The ARK funds have since struggled to reclaim their COVID-era heights and spotlight, however, there is something quite interesting about these funds.

In general, the funds try to invest in smaller companies that have the potential to become leaders in their niche. What’s different about their approach is that unlike other ETFs focused on a particular area, their ETFs don’t track a benchmark index and the holdings are almost entirely discretionary and subject to last minute whims with no set rebalancing calendars.

Luckily for us, while the moves aren’t announced in advance, they are quickly published by ARK with details such as trade amounts, updated weights, and rankings. Many ETFs also share their updated holdings data, but because the majority are tracking an index, the turnover (how often portfolio changes) is generally pretty low. With ARK funds, entire positions are often drastically changed in a single day with no advanced warning.

So, naturally, our inner curiosity gets going. Remember the effect we noticed with our index rebalancing experiment?:

Long story short, when an index such as the S&P 500 makes a rebalancing announcement, there is a highly tradeable effect where stocks newly added to the index tend to increase, while those deleted tend to decrease. We posed a few theories as to why this happens, but what if we could replicate this on a smaller scale with these types of funds?

Let’s find out.

ARK, Show Us What You’re Made Of — Literally.

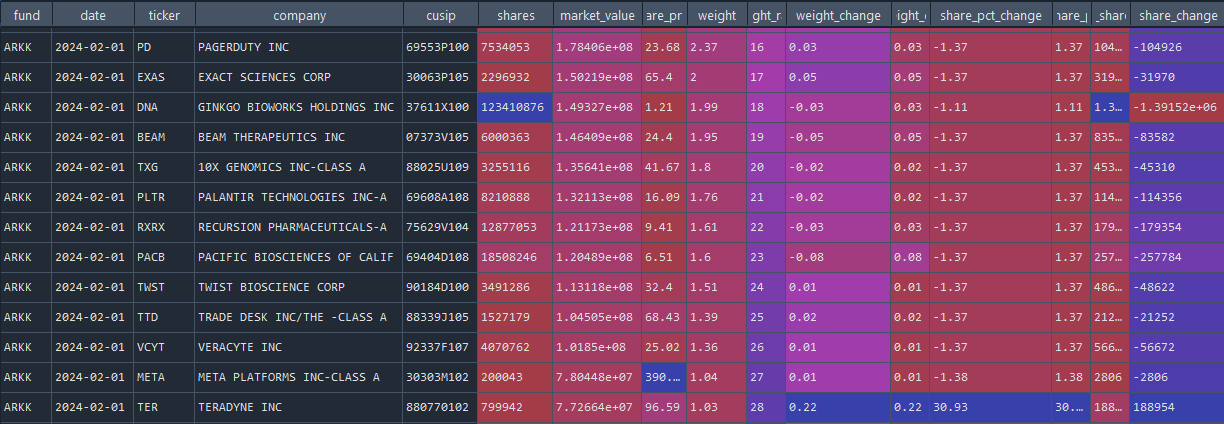

In order to get the answers to our questions, we’ll need to get our hands on some data. Thankfully, this is the easiest step as we can just pull from the open-source ARK Invest API (not operated by ARK). Let’s pull some recent holdings data to get a look:

A few observations:

As expected, you likely have never heard the names of most companies on this list. This is in line with their mandate of going for obscure, smaller stocks whose prices are by proxy more susceptible to buying/selling pressures.

The changes in share positionings are generally very algorithmic:

“Decrease the size of all 30 positions by -1.38% to finance a 40% increase in the size of Stock A”

Now, before we can continue into further research, we first need to create a sound economic rationale that will serve as our hypothesis to test:

Considering that the AUM of ARK funds are substantially larger than even the market-capitalization of some of its components, we want to test the same index rebalancing effect where — because people buy the ETFs continuously, that inflow of capital spreads to the constituents — conversely, when the ETF stops holding that constituent, it loses some of that buying pressure.

So, if an ARK fund drastically increases the size of its position in a stock, does the price of that stock tend to increase in the future? If they drastically cut their exposure, does the price tend to fall in the future?

Bonus hypothesis: It is very difficult to completely liquidate or fully add a new position within a single trading day. So, if we notice a sudden large position change, it could likely be a part of a series of future trades for that stock — for example, if ARKK cuts their TSCO stake by 30% in a day, they may be rushing to cut it fully and will continue selling through the week until they’re fully out. This creates a front-running opportunity.

To test this, we’ll design a simple strategy:

Holdings are updated at 4PM, so even before market open we’ll be able to know all of the changes that were made in the prior trading session.

If the position of a stock changed significantly (e.g., +/- 20%), we trade the direction of the move and hold it for 1 week.

For instance, if yesterday ARKK held 1,000,000 shares of Twist Bioscience (TWST), but as of today, they only hold 800,000 shares (a 20% drop), we would short the stock and hold that position for a week.

If today they held 1,200,000 shares (a 20% boost), we would buy the stock and hold that position for a week.

Let’s see what the data says:

Keep reading with a 7-day free trial

Subscribe to The Quant's Playbook to keep reading this post and get 7 days of free access to the full post archives.

![Index Rebalancing Is STILL a Rain-Maker Trade. [Code Included]](https://substackcdn.com/image/fetch/$s_!KE3o!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4e85ceb4-994a-42bf-989f-b7f1113e4421_828x517.png)