Volatility Arbitrage? Meet Sports Betting.

Sh*t just got real.

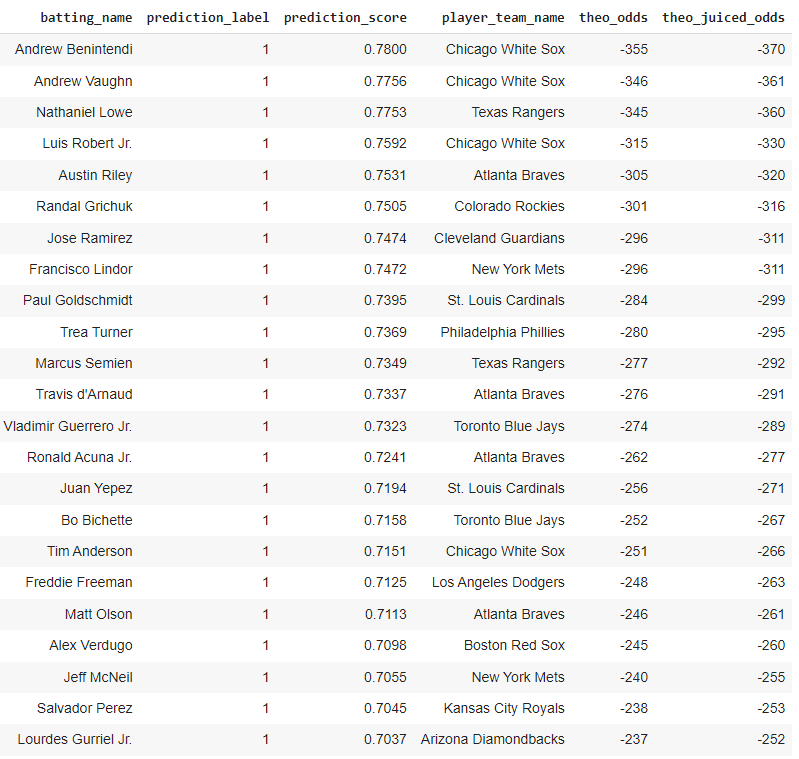

In the last update to the betting algorithm, we developed a logistic regression model for predicting the players most likely to record a hit during a game. Here’s how that’s going:

There is a lot of ground to cover, so without further ado, let’s get right into it.

And of course, if you’re new here, I recommend picking up here (it isn’t the start, but it’ll provide the necessary context):

Taking a Page From Finance: The Need for Arbitrage

Volatility arbitrage is a relatively simple concept. If there is an option that has a 35% implied volatility and a price of $5.00, but your volatility model posits that the option should really have an implied volatility of 30% and a price of $4.50, then you short the option and take an offsetting hedge. If your model says that the price and implied volatility should be higher, then you buy the option and take an offsetting hedge.

When looking at the sports betting world, we can consider the odds for a wager to be the implied volatility:

Naturally, we can take the volatility trading mindset and trade wagers where our model’s implied volatility (probability) is different from the market’s (sportsbook’s). In theory, that would be how we would get an “edge” over the sportsbook.

But is that even necessary?

To answer that question, we first have to see how well our model matches the market’s estimates in the first place. For our model to be considered good, it should generally have about the same probabilities when compared to live market prices (odds).

Fortunately, our model does match what is offered by the sportsbook, to an almost frightening degree. In a moment, you’ll see why it is a very likely probability that this is the exact same model class used by the sportsbooks to set the lines:

For each of the predictions, we calculate the theoretical odds for that bet based on the prediction score, which represents the output of the regression’s sigmoid function; and thus, the probability of the label being realized. We then apply a 15 point juice to simulate the sportsbook’s house edge. DraftKings has about a 15% Vig on their bets, so we apply that same factor.

However, for the highest confidence picks, like Nathaniel Lowe, for example. Vegas won’t set the standard (o0.5) line where you win if he records 1 or more hits, instead, they offer a o1.5 line. This means that, to win the bet, the batter has to record at least 2 hits. They set this line because they deem the probability of that batter getting just 1 hit too high to accept action on the standard o0.5 wager.

So, if our top picks are offered at o1.5 instead o0.5, and/or the theoretical odds are close to the real odds, then that means our model and the sportsbooks’ model are very correlated. Let’s see what the line is set at for some of the top players predicted (above predictions calculated on 5/13, DraftKings screenshots taken on 5/13):

Keep reading with a 7-day free trial

Subscribe to The Quant's Playbook to keep reading this post and get 7 days of free access to the full post archives.