You've Gotta See This Biotech Edge.

Big things come in small packages. The biopharma sector would agree.

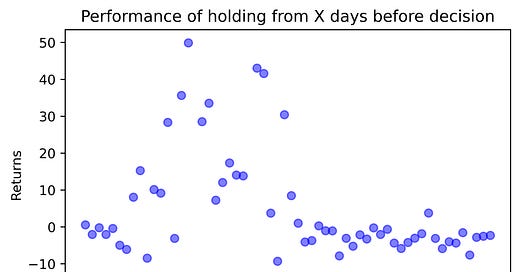

By exploring the price effects surrounding biopharma catalyst events in small drug manufacturers, we were able to discover an effect that produces an annualized 20%+ in uncorrelated alpha!

But before understanding how this works, we first need to understand a few things about this niche corner of the market.

PDUFA Day - The Drug Manufacturer’s Litmus Test

To better understand this, let’s put ourselves in the shoes of a small-cap drug manufacturer.

Your job is relatively simple:

Through research & development, you experiment and discover a solution that has the potential to cure a disease or help an ailment.

You run a trial with the new solution on a small group of people, and if those results are good, you run it again with a larger sample, if those results are good, you do it once more on an even larger sample size (Phase III).

After you’ve confirmed that the solution does what it’s meant to without any egregious side effects, you submit a new drug application (NDA) to the FDA and wait for their decision.

On the PDUFA date, the FDA announces their decision for your new drug:

It is approved and you now have the authorization to begin introducing this new product into the market.

You are issued a Complete Response Letter (CRL) informing you that it wasn’t approved, with reasons why and steps to move forward. But generally, this requires tabling the idea and starting over.

It is to clear to see why this PDUFA date is incredibly important to investors. To see this in action, let’s look at a recent example:

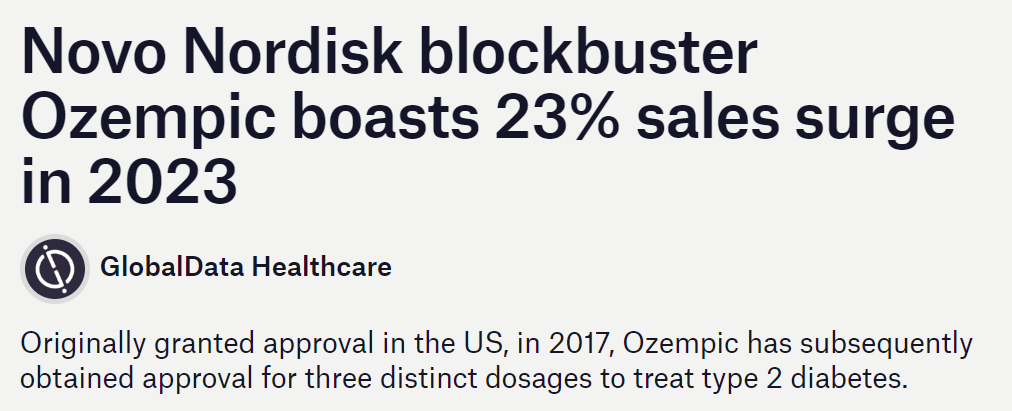

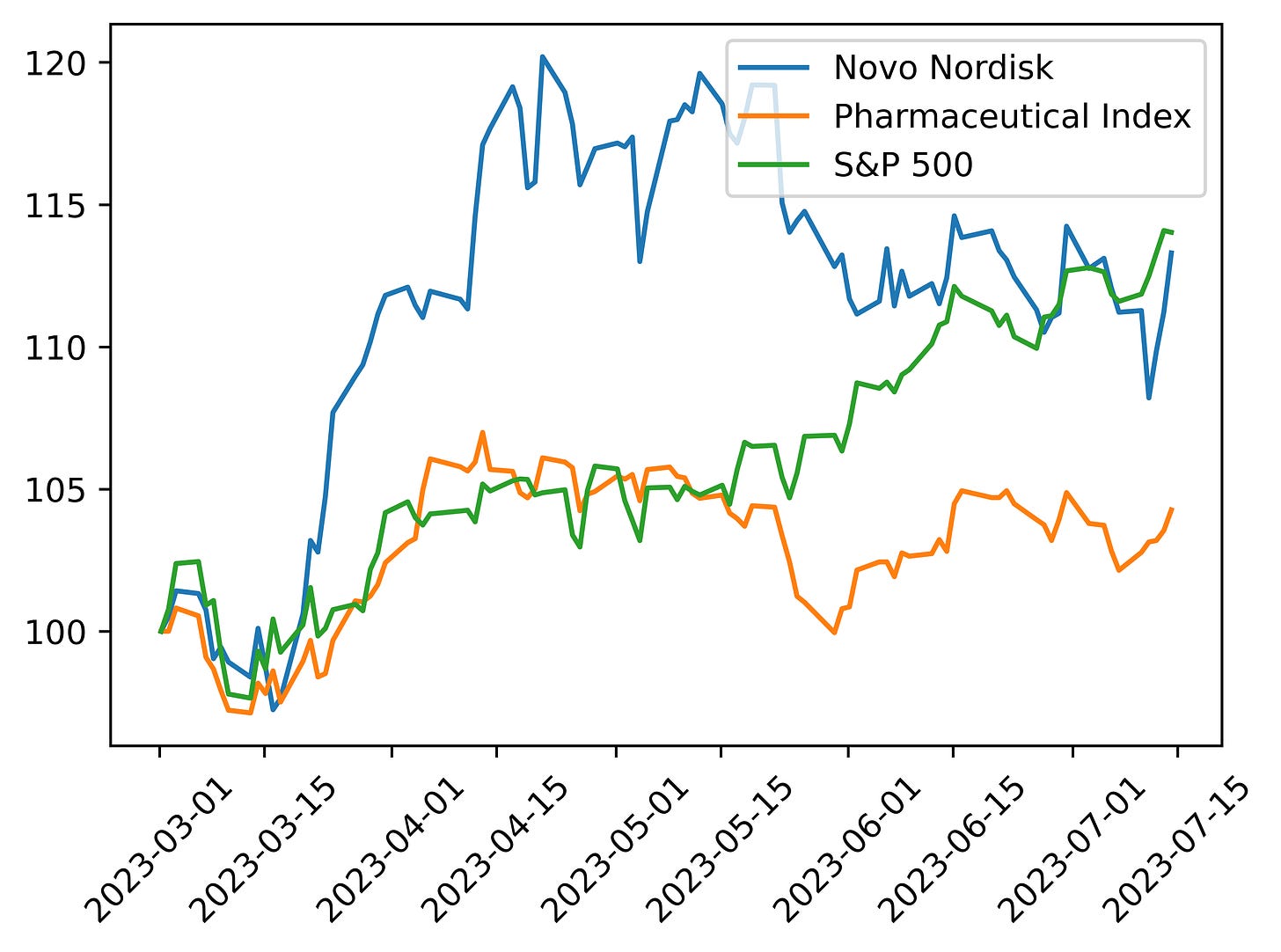

Ozempic, a new weight-loss diabetic drug which has been sweeping headlines, was approved for a certain dosage within the United States. Let’s see what the effect on business has been:

So, while FDA approvals can be a boon for the ambitious manufacturer, the same cannot be said for rejections:

As a result, PDUFA dates are a highly-anticipated event for both speculative traders and biopharma investors.

So, if we know in advanced where investors are looking, and what they’re looking for, can we dig into the data to squeeze out an edge?

What Does the Data Say?

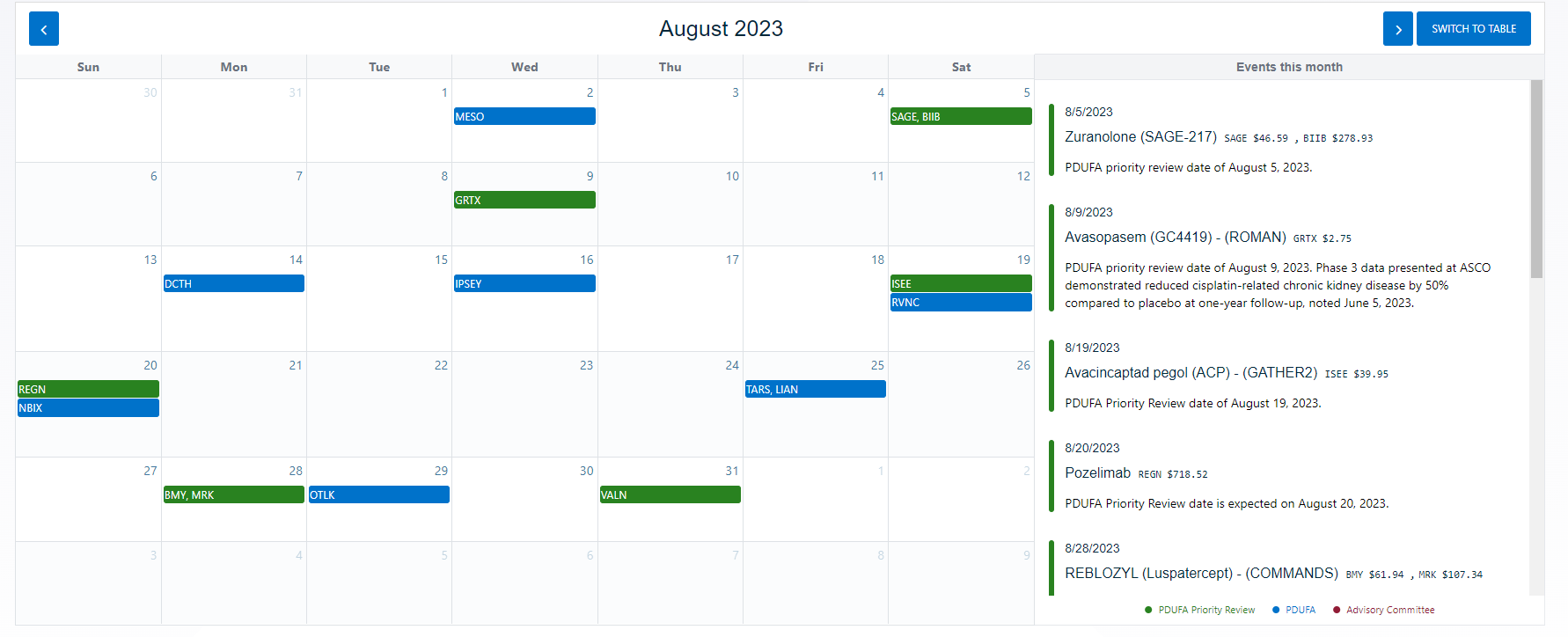

Since PDUFA dates are made public well in advance of the decision date, we are able to position ourselves early. To browse for upcoming and/or past events, we can use aggregators like BioPharmCatalyst or BioPharmIQ: